…

JP Doggett

I was just starting to give a bit of context, particularly for XXX who haven't joined one of these sessions before. Generally speaking, the idea of this is, as the name suggests, to share best practice. This one is a bit unusual. We usually have a case study which XXX, for example, has done for us, share experiences and lessons learned from a recent transformational initiative. Or we have something a bit more semi structured where we’d invite your input and flesh out an agenda based on that. This is a bit more free form and it's really just using the Gartner sessions that I attended last week as a jumping off point to see where there's some potential for discussion. I don't know if you've had an opportunity to have a look at the summary notes that I sent you but now is when I check to see if you've done your homework!

R

Those were the summary notes?!

JP Doggett

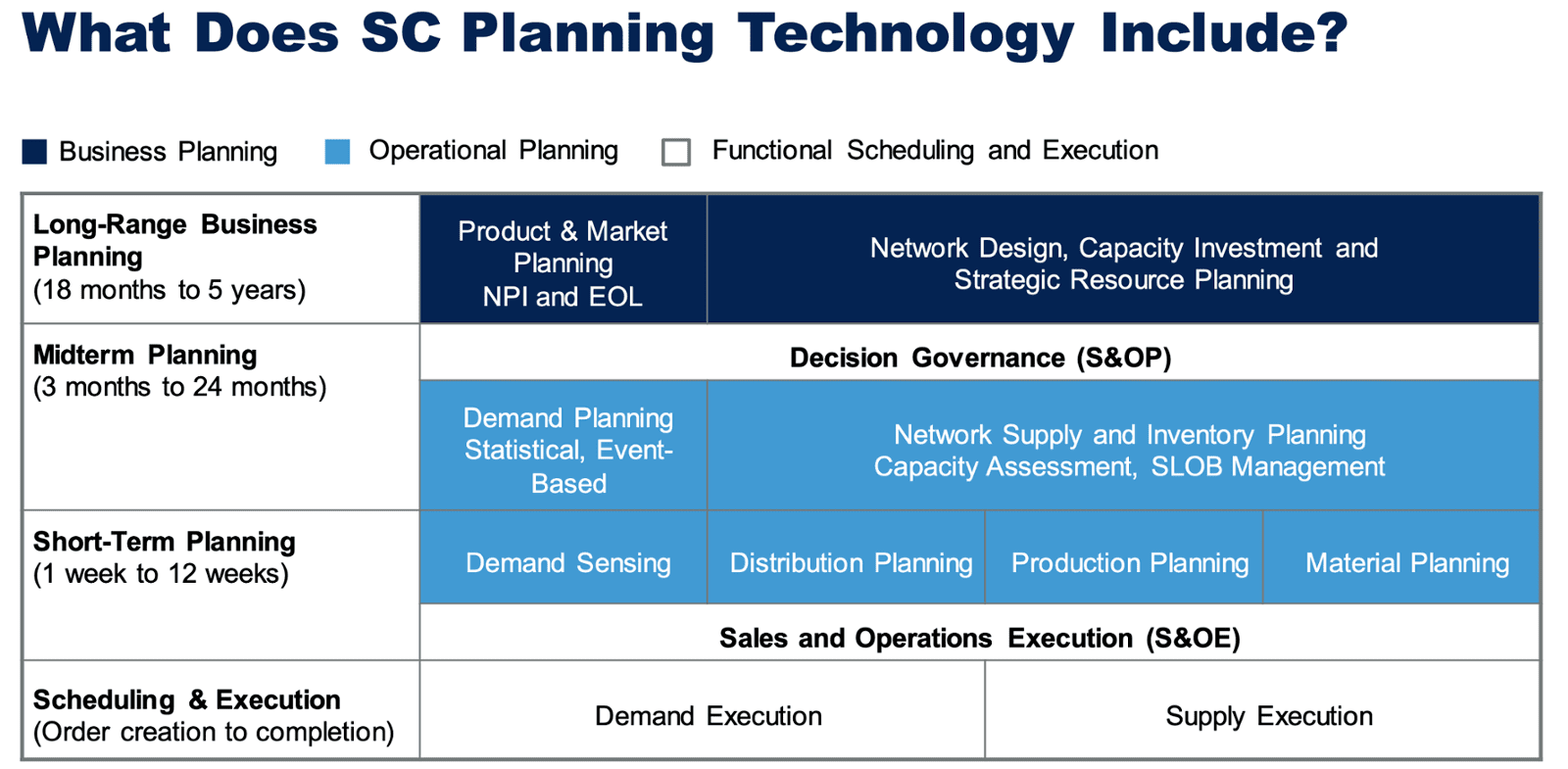

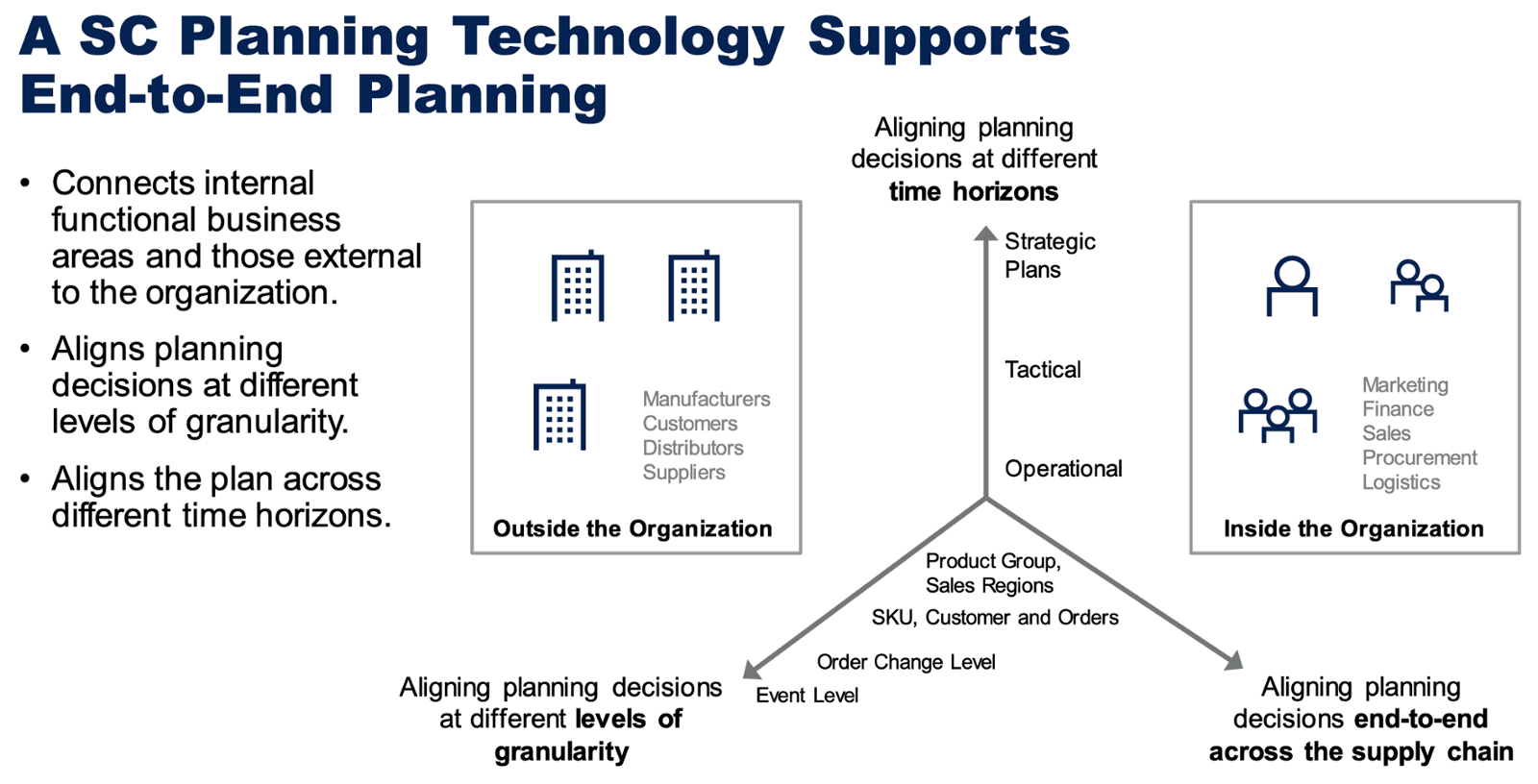

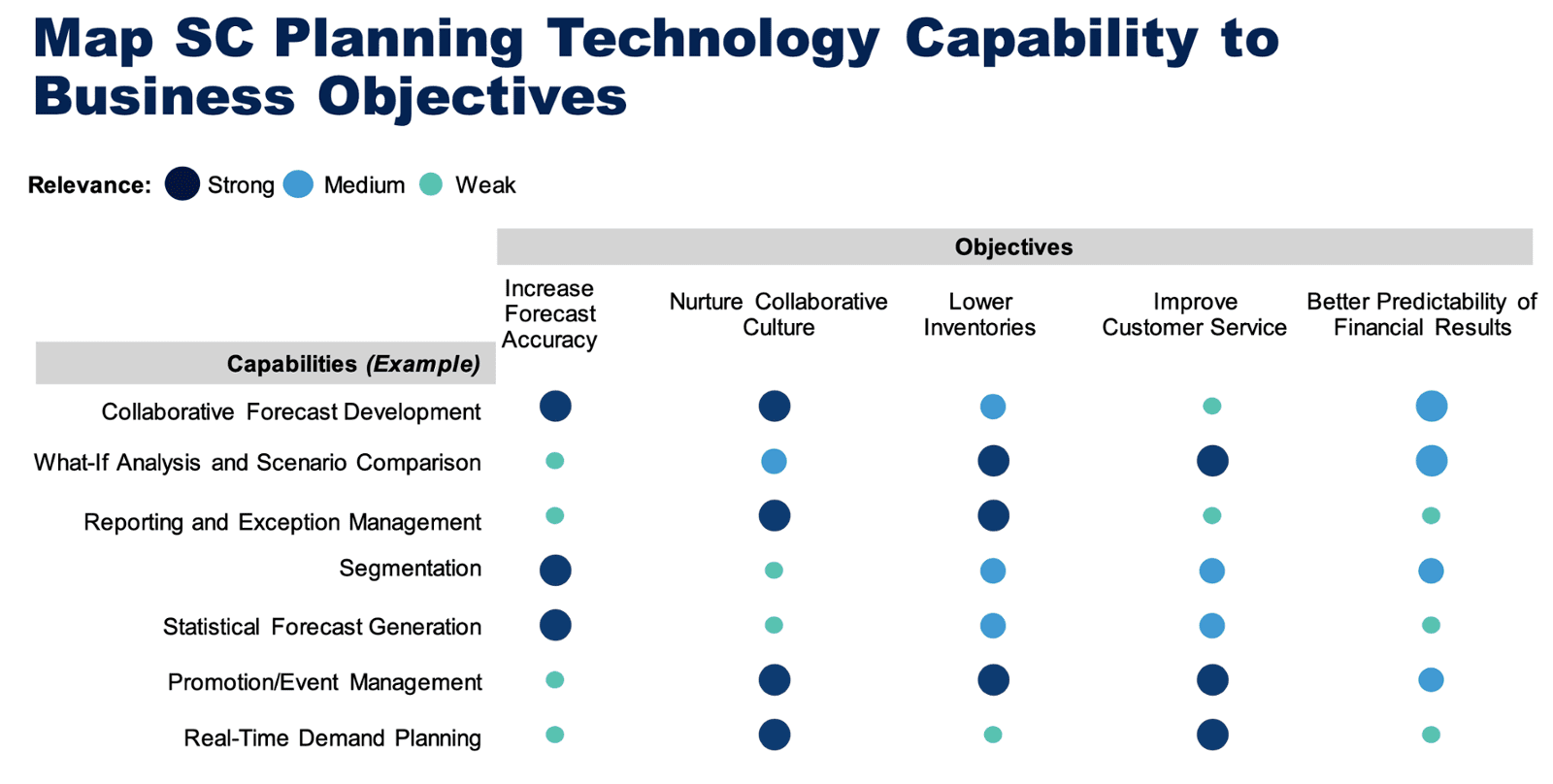

Sorry about that! The IBP session also had some interesting things on there which are applicable. I guess there are two aspects in principle that are connected. There's the process side of things going from level two to level three maturity and the technology side of things. I wanted to just start by getting a sense from you guys what you're most interested in. Maybe I can just have a show of hands in terms of the process, the early stage maturity, stage level two to three. OK, great, thanks.

And then from your side, C, should I read that it's more the kind of technology platform selection for you?

C

Yes. I mean, I can always learn. Always great to hear about what others are doing. I just think our culture and the behaviours are already very good in terms of processes for that. The blocker for us is less the engagement on it and more having a system that can offer us the flexibility and that can enable it.

JP Doggett

Okay, well, in that case, you might be our go to guy on the first bit on the level two to level three stuff. I guess the Gartner view is that going from level two to level three planning maturity is quite difficult and a lot of people seem to get stuck there because of the mindset change that needs to happen. Is that something that everybody generally kind of agrees with and identifies with?

All

Yes.

JP Doggett

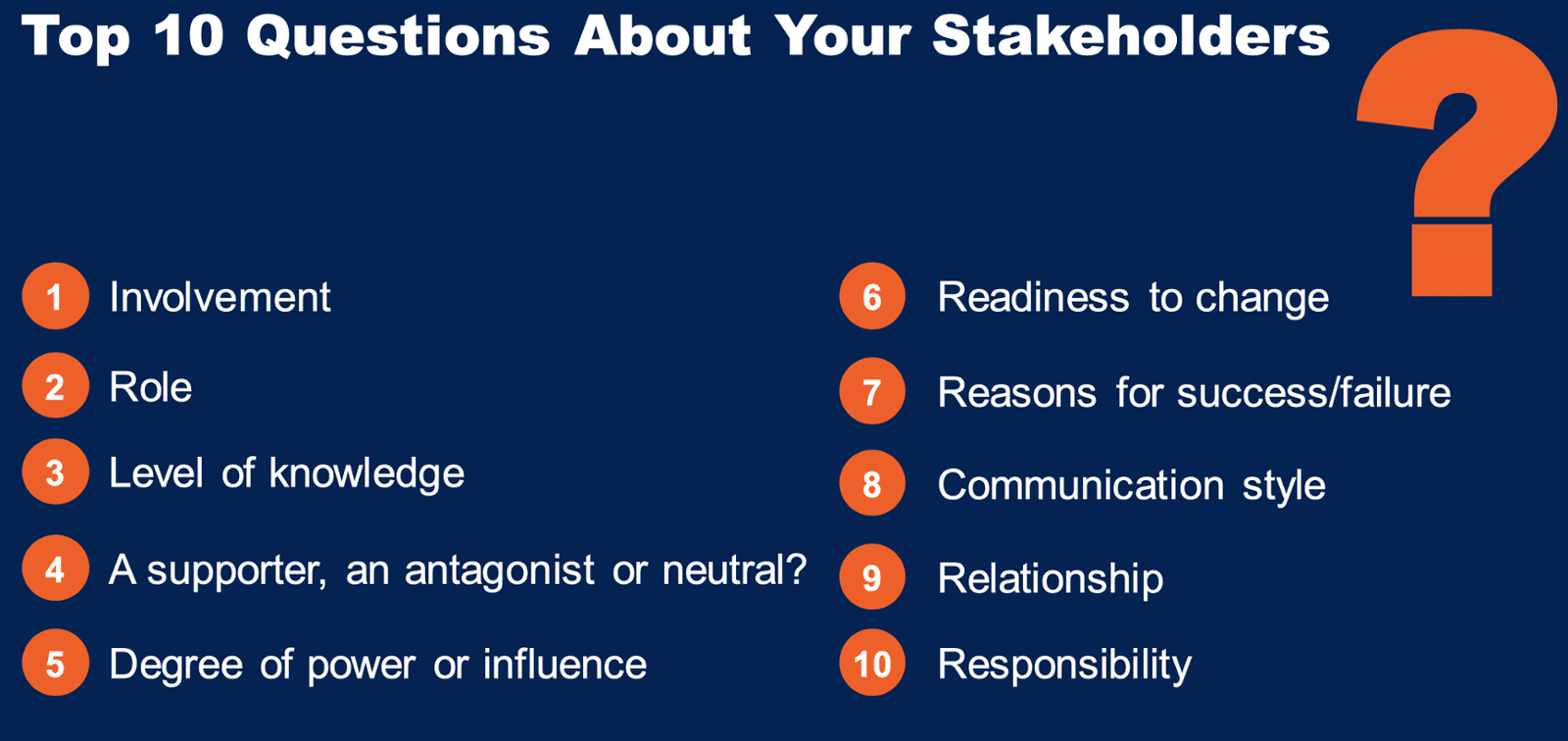

The reason that they highlight is stakeholder resistance, getting everybody to see this is not just a supply chain thing, but something that's relevant to the whole business. How have you dealt with this, C?

C

I mean, I've been fortunate enough, by the time I joined XXX, they were already quite well on the way with the IBP process and had adopted it. Certainly within the European business, we went to a global structure and I suppose there's a bit of trying to catch up with the Americas on the cadence of the meeting, the inputs and outputs of it. In terms of resistance, it was already well established from the absolute top of the business down with all major stakeholders. I recognised some of the behaviours that were in the document in terms of being able to sandbag and things like that. Still, that behaviour does happen on rare occasions, maybe in certain operating companies or operating country groups within us, but it's individuals rather than a general behaviour.

From my understanding, it came from being able to establish the benefit to the business very early on. I think that's absolutely what it was: speaking in those dollars or pounds and pence on the benefit of it and being able to show quite quickly on inventory reduction that then convert that to value. It's always that conversion of value for me, even in previous businesses when I worked at XXX, it was always about being able to put that EBIT benefit on it, I suppose.

JP Doggett

And is that now just established practice? There's no regression to previous muscle memory?

C

Yes, I would say there's a couple of country groups in the Americas where the behaviours are not quite as slick or when we come up against the challenges of a constrained demand market in terms of you just cannot physically supply what you need. Then, you start getting the old behaviours from the commercial side of the business where they might exaggerate what they need feeling that, if they don’t, they won’t get any of it. You then have to go back to the opportunities and vulnerabilities management and really focus on that.

JP Doggett

I guess when there's a clamour for scarce supply, then people want to kind of get their claim in first.

C

Exactly.

R

Ironically, that's when you need to follow the process! It's kind of a vicious circle, isn't it?

C

Yeah, absolutely.

JP Doggett

So, in terms of navigating the earlier stages of planning maturity, what are your obstacles, R?

R

The immediate one is education. Everyone in the business has a different view of what it is and what it should be and what it means to them. That's the first one. We have gone through an extensive education process where we have virtual sessions, we have workshops so that we can start to standardise the view of S&OP across the business and among our stakeholders. At least we've actually got the same objectives going forward. The next thing is mindset. There is the usual pushback with commercial buy-in because the commercial team feels that it's restricting and you can see the colour drain from their faces when you talk about constrained or unconstrained demand because constrained to them means “I'm not going to get what I want”. The stakeholder management is key and one that has taken a couple of months. The improvement is that our previous sponsor has moved on and we've got another sponsor who is more engaging and more vocal, I would say.

Now we're at the stage where our strategy is to kind of put the technical side on the back burner for now and work on people and process in terms of what are the processes we have now, what is working well? How do we join them up? How do we start having those conversations and having those reviews and action planning and scenario planning? Because for me that's the essence of what S&OP is about, and the system enables that. If we have those conversations first and we have the process first, we will also be better able to decide what's best for us to enable the process. That's where we are at the moment. We've decided to pilot rather than go big bang. We have two regions that we are piloting. One is Germany and one is China, just to get a different view. We did the first one last month, we're doing the second one now. It's interesting to say the least, but we're actually finding our way in terms of what our templates should be.

JP Doggett

Yeah. Okay. Thanks. I'll just go around everybody and then open it up for you to ask questions to each other. C2, can I come to you next. During our short conversation last week, from what I recall, you've got a level of planning maturity, but you are part of a wider business group where that isn't so established. In a way, your challenge is getting those other units on board, if that's correct?

C2

We have just been acquired by XXX which has several much bigger companies. In the last two years, we spent a lot of time implementing a demand planning, supply planning and inventory planning process because, before that, each market was basically completely working in isolation to each other. We did that and we had quite good success with that. But that stopped at volume. We are never speaking about value because the mentality within XXX and YYY is that each business unit is completely independent. They are responsible for their own P&L, for their own success, basically. We cannot really have any global view in terms of sales or anything like that. Currently, S&OP is more seen as a supply chain exercise because you want to know how many machines or units you need into your warehouse.

Now we have a further change because now with the integration with YYY, we have a massive beast that is completely independent. I mean, literally, the philosophy is really everyone for themselves. That's now bringing that together and basically bringing this YYY community, which is 22 markets in Europe, to actually work in the same model we have in XXX. Now, thinking about S&OP, honestly, I'd love to do that, but that's maybe five years down the line. A lot of the points that we have mentioned, I absolutely agree with. I mean, just looking at what went through in the last two years in terms of education and mindset, when I started to speak about demand planning, people felt that we cannot plan the demand. It's not possible as we don't even know what will happen next month let alone what will happen in six months time.

That was a massive amount of work. In terms of educating the people for them to understand what is the process, what are we actually asking them to provide as information. I absolutely agree with that and I think your point about people and process. First we did that, we really focused on the people and process. Our initial tools were Excel. Now we're looking at investing into technology. We worked on a very basic Excel platform and we really focused on the people and the process and that was relatively successful. Right now we’re moving to the next step. It's hard to engage the management to look further than just volume. That's really challenging because there isn't really an understanding of what is the benefit and there is a feeling that information like financial planning is kind of secret or is only to be seen by some people.

JP Doggett

Thank you very much, C2. S, can you give us a picture of where you are within XXX?

S

I think we are between the first and second stages. I'm looking from a regional level, but we have established S&OP processes where we have a certain level of planning capabilities, where we already have those first layers of collaboration between certain of the business functions. Where we are struggling is with harmonisation and synchronisation of that data because we work in fundamentally different ways. IBP is rolled out in all of our regions, however, it's not being used consistently. We still have issues with system setup. We still have issues with simple things like disaggregation not properly working, which is completely limiting the functionality. So people default back to Excel. We're really putting strides into understanding what are those market requirements and making sure that the system set up is working with their market specific requirements. Mindset, fortunately, is quite good with us. We have a lot of senior stakeholders with a very high focus on S&OP.

It's really kind of embedded in the language here. I actually only joined XXX about three months ago and I come from a consulting background, so I've seen a lot of different organisations and I must say we're quite far with how it's embedded in the culture. It's just really that standardisation that we struggle with. The next step for us would be roll up. We have all the market related data, how do we roll it up to global to make sure that we can use that data with our OCs and really push that kind of supply planning side as well. So we're strong in some parts, not so well developed in others.

JP Doggett

Okay, thank you very much. D, I deliberately left you to last because obviously you have made some big steps on the technology side and maybe we'll kind of segue into that second part and the business case side, but just sticking to the process side of things at the moment, where do you place yourselves now?

D

I think the two go together in a way. First of all, we put a business case together to implement the new supply chain planning system and it's probably fair to say that not everybody in the business knew all of the potential of that new system. They probably saw it as a replacement for XXX, just new technology. I think the road that we're on at the moment is getting the buy into the S&OP process to start off with, but then introducing people into monetising the S&OP cycle. We're trying to bring in annual targets in terms of revenue and inventory levels, freight costs, backlog values and that kind of thing. Trying to create an executive dashboard that has quite a lot of financial numbers. The challenge at the moment is that it's hard to extract the right financial numbers. S said about disaggregation and average selling prices. It's not going to look perfect to start off with. We're working on the assumption that we can lead people in and say, look, this is what we can now do. We do have the data, but we need more business process buy-in, particularly from finance, if we want to really leverage that because we do want to go towards a more integrated planning process with more assessment of our scenarios against the actual business targets of revenues and inventory targets etc. It's like, I think we're going to go on a journey and the technology is now enabling us to do more than we would have ever been able to do with our previous planning system.

JP Doggett

Thank you. I think that's kind of a common theme about the stakeholder buy in, not just senior buy in. I think one of the things that got repeated in a few of the sessions last week was this idea of having a compelling story, something that everybody identifies with, and trying to attach that to a couple of the KPIs that they care about so that they don't just see it as a supply chain thing. Does anyone have any actual hands-on experience of how realistic it is to come up with that kind of compelling story as the vehicle to get buy-in?

D

Certainly, going back to our previous conversation, the buy in came from a senior member of our team recognising some of the challenges we had and recognising the capabilities of the new system to help resolve some of those issues, without trying to put together a financial business case that said we will reduce inventory by this much or will increase revenues by that much. It was much more of a belief that there were business challenges that we had and for us it was particularly the scenario planning capability of looking at what would happen if we saw significant increases in demand, how quickly can we respond to those and it's very difficult to financialise those. Yeah, it did come from that buy in from senior management to allow us to proceed with that business case.

C

It's a bit similar on our side. In the last twelve months we had a couple of situations where some countries made decisions in complete isolation of the rest of the group and decided to buy a lot of inventory because they had a feeling that it would sell. Obviously this raised our inventory value significantly and the management wondered, why did it happen? We explained that it was because we don't have the visibility, we don't have the tools to be able to enable us to control that. Suddenly that led to a lot of realising that maybe we need to do something different, maybe we need to start investing into a proper platform that allows us to have this kind of, not necessarily oversight, but at least having this understanding of why people are making decisions and so helping them make the right decisions.

Also last year we had to move our factory in China because of a new Chinese law and we had to do scenario planning in terms of how we manage the move. I can't remember the number of extra spreadsheets I had to be able to do all the scenarios. My boss said, well we cannot keep going like this, we have to do something different that's not sustainable moving forward. It was more kind of an event that enabled us to be able to put forward a business case and then to be honest, the management didn't really care about the value to some extent, but more about what is the capability, what it will allow us to do moving forward..

S

Can I ask a quick question? How are you doing your scenario planning? Because that's one of the things that we're very immature at. We're more at the reporting level still with our KPIs, this is what happened and this is how we're going to solve it. But we're not yet at scenario creation. How do you do it? Which tool do you use or talk to them? I understand you both do scenario planning?

D

We haven't done it yet but XXX is almost structured around the concepts of scenarios. You have your baseline and you press a button to create a scenario and it just creates a complete copy of the whole business model and it allows you to just play with any of the parameters in there.

That was one of the selling points of XXX is that compared to XXX that we’re on currently…we just can't do it.

S

Okay. And C2?

C2

Very old fashioned: Excel. New scenario, new Excel version of the file. That's why we're moving to a solution to enable us to have scenario planning.

S

Yeah, that's always the question. Okay, anyone else that has scenario planning?

C

We are the same. It’s all XXX. If we need to run scenarios it's very often extracting it into Excel and trying to give a high level view of what it is. Back to the point I made about the enabler for moving on, these new products on the market seem to be offering scenario management as the major selling point. That's one of the major selling points that I need to get across to the business for investing in this because right now it takes too long to run the scenarios and produce an answer as the picture has already changed.

R

For us, it’s the same…very much Excel based. We use XXX as our forecasting software and we extract information and data and luckily I've got an Excel whizz on my team who's able to put formulas in and make the job a bit easier for us. But it is very much manual. Just going back to the business case in terms of the S&OP, I'm at that stage now where we're looking at success factors and what S&OP is going to drive and it is so difficult because how we are structured is that each function has their own objectives and KPIs and they're not connected. The sales guys’ is to sell more. The inventory team’s is stock health and reducing inventory. Therefore you have a conflict straight away. You're talking about is the success factor going to be about reducing excess stock? The VP for inventory is saying to me, “I can't reduce excess stock until commercial gives me a better forecast. I'm not signing up to something until I can see the process that's going to give me the information I need to make those decisions”. You go to commercial and they’re asking, “will I have the inventory to sell to increase my sales that S&OP is going to help me drive?” so it's kind of breaking down those silos and changing mindset is the challenge for me before we can get to that business plan and benefits.

D

Do you have a chief supply chain officer equivalent?

R

No we don't. We’re a very decentralised organisation and, although it has logistics functions, that tends to mean warehouses and lorries and I do sense that any organisation that doesn't recognise supply chain as a key function will struggle to get an integrated planning process in place because there's just no recognition of the need for it in the business.

C2

I don't know if it helps. One of the ways I used to monetise the benefit of the planning is we took the example of the decision that was made locally and basically what I presented that is I said, “okay, if we had a consensus planning at the time and if you had visibility of this initiative would you have signed up for this three quarter of a million of investment?” They all said no and I said, “Okay. Well the benefit is X. We could have avoided that” and although it's not a great business case per se, it does speak to people because it's actually something that did happen. They can put a number against it and it doesn't matter if it's sales or inventory or whatever. It's actually something that did happen and people can relate to that.

R

That's a really good point and that's what we're leveraging because even from just having one S&OP run through last month. Some information that was shared in terms of a promotion that's been done in September and it's shown is that we've actually outperformed the forecast by 20% and how much more could we have done if we've planned it upfront. What we're going back with now with the next one is the scenario around if we’d had this S&OP process in place three months ago, we could have put that into the forecast. We could have got the stock in. We could have given a customer a better experience and that's how we make the case.

C

I think on a couple of points in terms of how do you win the hearts and minds of it: I think at a general level you'll do that at the top level anyway with a very generic reduction in inventory, improvement in forecast accuracy and, therefore, agility in sales. The way that I've seen that seems to really crop up and keep it going is using the real examples continuously as you go through the process of highlighting why the process is working on a case by case basis and when it's not. And we do that sometimes. For example, if we'd known about that 20% so this is what we could have done. Similarly, when we come across problems where maybe something's not happened, we use the S&OP process or the IBP process to illustrate what we’re able to do and what it means whenever we come across challenging times. It's keeping that message fresh because you might get the buy-in initially, but when you don't immediately start proving profitability by tens of millions of pounds and it's not happening all the time, then it starts going off the boil.

On the point mentioned before about having a recognised supply chain function and CSCO, one thing I've noticed that wasn’t the case at my previous two businesses is that the Head of IBP or the VP in charge sits within the strategy team, not within supply chain. That VP is in charge of strategy and IBP, has the accountability and is the cheerleader for managing the IBP process.

If I think back to my team in XXX or XXX, very often within supply chain you have people titled Head of S&OP or S&OP Manager and they were all supply chain roles. That meant that it continuously reinforced the belief that S&OP and IBP as a supply chain driven process. When I joined XXX, I was surprised to find out that it's the Vice President in charge of Strategy and IBP and they are the most senior person that has got the IBP accountability. The Head of IBP or IBP Leader is the one person who goes to all of the meetings through the process and makes sure that the global and the local schedules all work together and continues to develop it so that we see gaps coming up. But that comes from the business strategy team rather than the supply chain or commercial or anything. It works well because it is a strategic process.

S

It is and it's not. And that's the biggest problem for us. S&OP is led by market S&OP leaders who are at the moment doing supply planning…calling trucks and so on so their window is zero to one month. It's crazy. How can we elevate our people and make it more strategic? That's a super interesting thought that potentially we're reporting into the wrong dotted lines.

C

I should say that the majority of the leg work happens within demand planning and supply planning. But, from a business point of view, if we need to change something or the IBP's not working, they're speaking to the strategy team, not the supply chain team.

S

At XXX it's co owned between finance and supply chain so supply chain is doing the demand planning and it's kind of alternating who owns each section which also works really well to get that kind of ownership throughout the business.

R

Interestingly our sponsor now (I mentioned that we had changed sponsor) is the President for Commercial i.e. sales so that gives us a bit of a foot in the door.

JP Doggett

It's a really interesting discussion. I am slightly surprised though that there is still so much resistance or difficulty for other stakeholders to see the business case of doing S&OP or IBP because I thought one of the silver linings of the pandemic, if you can put it that way, was that it kind of made the case for better coordination?

R

For us, during the pandemic, we actually did very well. Our sales were up. We responded very well to the situation in terms of it was a disaster and we are very good at firefighting. S&OP is kind of the opposite of that. The other thing as well is that over the years we've managed to do very well without the process so now the struggle is why do we need it? It's kind of not coming from a place where we need to improve but the selling point is how much better we could be and sometimes that is a tougher sell.

C2

For us the same thing: we had a very good Covid...let's put it this way. But I think the business recognised that all the planning processes and tools we put in place are very useful and we must have them and they are really kind of supporting investment but why go further? Why do you want to do a full S&OP? What's the benefit for the business? What does it bring me in terms of information? I mean, if you can get the right product at the right time at the right place…good, check.

They don't see the benefit of the next level yet. They definitely see the benefit in having a proper demand and supply planning in terms of volume but that's currently stopped there.

S

I think for us, I don't tend to agree as we have a lot of buy-in. Our organisation understands and they see it. For us, it's really that bringing it to the next level of making it more strategic, making it further forward looking and training people right and making them truly understand what they need to do, but they know they need to do it. It's just elevating our people to gain those capabilities. It's not that they don't see the need.

JP Doggett

Yeah, I think it's that thing about a burning platform, right? I think I saw in a Gartner report or something else that actually the companies that are doing most on this are the ones with the thinnest margins because they know they need to do something. Whereas, speaking to a member recently who is trying to do exactly this, he’s struggling to get the buy-in because the margins are still good. Why do we need to worry about this?

Moving on to the technology side of things, I'll come back to you XXX because I think you started looking at options so how are you going about it? What's your process?

C

Yes, so we started looking this year specifically to what's available in the market for the next generation and we used the Gartner Magic Quadrant to start with. I've been reaching out and just trying to get an overview from some of the more top right solutions just to understand what’s available. As we are talking about, it does seem to be focused on this scenario based logic and complete digital twin approach. We like to think we're very aligned, we put everything into XXX and XXX but the reality is, on the financialisation, that gets extracted into another system and worked up there. That doesn't happen as frequently as the forecast so it's not truly available in our planning. We’re manually going and planning the downtime, we don't have that coming back to us. That seems to be the new way of working around this artificial intelligence sensing of everything from the demand signal to the maintenance scheduling and then the immediate feedback on the financials. That’s why we're still using Excel spreadsheets outside of the process to do scenarios. Whereas, if you've got that full digital twin, you can do it. We've been speaking to these companies and I was originally targeting having maybe two or three contenders that we wanted to move forward with by the end of this year and then start working. What became apparent is that it's not a supply chain decision as much as a business decision because we need to get the most out of it. We need that digital twin. I need manufacturing to be fully aligned, I need finance to be aligned, I need the commercial strategy.

Right now we're at very different places within the business on what our digital roadmap would look like. That's almost been the biggest learning for me over the last few months. It's to actually go back and say we need to come up with a digital roadmap for the business, not by department, because that is the only way to extract this value and take the next step forward. Otherwise we will spend a lot of money on a system that will be limited in its operations, because it's not linking up with that full integrated supply chain.

S

You say you've already investigated some vendors looking at digital twins and AI and all. May I ask which vendors you had shortlisted that are already kind of at that level of digital twin for S&OP?

C

So we've spoken to XXX. We have spoken to XXX. We spoke to one that wasn't even on the Magic Quadrant, but it was much more on demand planning and that was XXX. I'm due to speak with XXX, that JP put me in contact with.

S

Are you thinking about doing digital twin also then for your manufacturing processes or only your business processes into the supply chain?

C

Yes, certainly from our point of view to extract the value, it would require the full digital twin of both the physical manufacturing process but also to flow through into the other business functions.

S

Interesting. We're starting to think about our roadmap. When will we be ready? Because you don't go from Excel to digital twin, right? Like there's a few steps between.

C

I suppose we’re fortunate that we have a lot of the business in XXX. It's just the linking everything up. I suppose, more recently in the last couple of weeks, where the thinking has gone is if we can't go full wholesale digital twin in the current state…the driver for all this is the XXX support stopping in 25, 26, 27 as it keeps being delayed. But that was the original driver. If you look at XXX, that's a complete replacement for XXX, whereas when I was speaking to XXX and XXX, it's very modular. They will give you a demand planning module, they will give you an inventory optimisation model. Having spoken with them, I'm trying to work now to understand do you maybe want to start using some of the modular approaches where we know we can be in control of the demand signal, the inventory optimisation but that doesn't have the full digital twin, that doesn't have everything coming in.

C2

Just a comment on XXX. I did implement XXX in my previous company. What they sell and how it happens…there's a massive difference.

S

All of them, guys, we always need to be mindful. There’s a lot of buzzword bingo when these vendors come in. Everything is AI but nothing is AI.

D

Yeah, I was going to say about the digital twin bit because I think people again use that word a lot and a supply chain planning system will say it's a digital twin but equally you might have a digital twin of your physical products in their applications and that sort of thing. I don't think we've thought that we're going to combine absolutely everything. XXX is a planning tool and once you've got your plan out there in the execution world, then you let go from a XXX perspective and go into your execution system. I don't think you have to try and digitally twin everything into one system.

S

It depends on the purpose I suppose.

C

That is similar to XXX and they seem to work in the same method. I’m very aware of what they sell versus what they can do is but the one thing that was missing on the modular tool that XXX showed me as an example was that if it is showing a shortage on this product right now and this is the revenue impact but if you were to move it from this production location to this one, then you will cost X amount, but your margin as a business in revenue would be here. That is what we are trying to do right now on Excel spreadsheets globally, in a constrained market. We can't supply that from the UK or from Europe or South America. How much would it cost us to make that in Asia and get it sent over versus walking away from this customer that we don't have a contract with but make a good margin from? This is all done on Excel spreadsheets and XXX seem to be able to sell that as a differentiator whereas XXX is more, here's the scenario, if you think the market is going to grow by 10%, then this is the impact. If you think that this external factor, internal factor, or something happens, then these are all the scenarios you can manage.

S

But that's not AI, right? That's just algorithmic. You could just create a nice little Excel dashboard to continue with that. For me, AI is filling in those gaps and data that you don't have right? Like scanning through news, understanding that there's going to be flooding in Thailand so what does that mean for my supplier? Giving those predictive insights on what that means and that these are my options for mitigating the risk. That's what I would want from a system.

C

Yes. I think if we were not so far back in the supply chain, if we were FMCG or later, then you would get much more use. But being almost a raw material supplier, we’re on the other side.

C2

When we are selecting the tool, we ask ourselves what do we want to achieve? Basically, I mean, when I look at our product, we're not launching a rocket to the moon. We have very basic commodities. What we need is a very simple demand, supply, inventory and then we can build on that. When I look at things like XXX, XXX…they’re brilliant tools, don't get me wrong but it's like taking a bazooka to kill a fly. Sometimes you just need to go back to basics and say what do you want to achieve and how, in which time frame. To be honest, my view is maybe better to take something simpler at the risk of having to change in three, four, five years to get to the next level. You mentioned XXX and actually that's the one I'm thinking about because it's the one that offers the most modularity in terms of building a solution moving forward but starting simple and building and building on it.

S

So the question is also getting stuck, right? Like if you go with one with the intent that it's modular, you're never going to be able to extend.

R

We were looking at different solutions and we changed strategy to focus on process. We did have demos come in and we shortlisted people and XXX was one of them, XXX was one of them. And XXX.

D

From our experience, you really have to push them to actually upload some data and create a working environment so we could actually see it working for real. XXX weren't prepared to do that. It's unfortunate, but you actually have to invest a massive amount of time. Somebody said, “tell them: no PowerPoint presentations when they come in”. You want to see the system replicating your type of business scenarios. Like I said, it took a couple of years and a lot of work to get to the conclusion, so you have to be thinking quite a long way ahead.

R

Absolutely. That actually brings home which one of these suppliers understand your business based on what they put in front of you and what they're demoing. We went through a shed load of these solutions that came in with manufacturing solutions, whereas we're a distributor, so a lot of it just wasn't relevant.

JP Doggett

I was just going to say, guys, I’m listening very intently and I declare an interest in that. Part of what we do is to understand what you guys are trying to achieve so that we can try and identify the kinds of platforms and solution providers that would be interesting. I’ve put a lot of work in over the last few months, actually, into solution providers that are less well known or not on the Magic Quadrant, because I think from conversations that we've had, XXX, that's the starting point for 99% of everybody and you talked about how difficult it is to find the time to consider all the options you probably should and, very often, you have to just go with the ones that are most well equipped to engage you.

For example, one of the guys who some of you will know from having been on other discussions recently, I joined his demo yesterday, and I think he's got the similar challenge that you were talking about, C, in terms of just that particular piece on understanding the financial implications of supply constraints. They know they're going to use XXX. They already have that in the States and they're going to implement it for the rest of the business, but not for another three years. They're looking for something that’s going to bridge that gap between today and three years from now. So, that's really my question. Is there value in that? Is there value in identifying and maybe engaging with less well known, non-Gartner magic quadrant suppliers that can offer modularised solutions that could at least be a bridge to a fully integrated solution once all parts of the business are ready for it or maybe even be part of a longer-term solution?

S

Why are they waiting three years? What's the reasoning behind that?

JP Doggett

I think it's just because it's quite a big roll out. I think they've had acquisitions that aren't perhaps all on the same page at the moment. I don't know whether he's just being a bit realistic or maybe pessimistic that it's probably going to take three years when people might be saying next year. The key thing is that he is looking at something that might bridge the gap because he doesn't expect it to happen quickly enough to be able to prevent the losses and the issues are having today with too much inventory.

C2

One of the answers to that is you have to take into consideration maybe two or three things. First of all, do you have access to all the data from your local market? Do you already have something that you can already plug in and then you get the data because if you're not on top of that, you have to build something specific for the patch and then you will have to rebuild that moving forward. That's a pain in the back side. The second thing is, let's assume you get the data in an easy way and you want to build a patch, you need to agree that you have to do so with something that you don't have to make in development. It's basically this is the screen, this is what it looks like. Deal with it for the next two or three years.

Because you don't want to invest, like I went through with XXX, you have to invest months to develop the screens and the logic and stuff like that. You don't want that for two or three years. You need to do something like XXX for example, where you plug the data…boom, it works. You don't develop anything. Basically.

C

My thinking on it and what I’m still working through at the moment is I agree with you: if I'm going to have to invest lots of money also time to change people's ways of working for a few years…no. But, if I can get a sweet spot with a modular system that is a complete overlay to XXX which we have right now then I know that, even if it's a pilot market like one or two country groups for a couple of years, if I can prove the concept of the scenario planning, speeding up the decision making and maybe demonstrate how much time we no longer have to spend in Excel.

It's the time that takes the team to do things in different systems which is the big pain point. We're very lean in terms of our organisation. Normally only one supply or two supply and one or one two max demand people per country group. So that could be the entire North America. You've got one, two supply planners and two demand planners for the entire continent. For me, I’m still trying to figure out if there'll be a value in being able to do a proof of concept with a modular system as long as there's not huge development and lots of customisation. We can prove this concept of being able to use scenarios because I also want to change the way that the demand planners think and get them used to considering different scenarios. We have very limited market data available to us apart from our customer forecasts and news and data that's way out of date.

So it's trying to utilise that. I'm trying to weigh the pros and cons. I need that price from them to start with and I need to understand the full development, but it might be worth for the next three, four years taking a demand planning solution for a couple of markets knowing that XXX and XXX will be there for us if we need to go in at that level. If we can get it working then, when the next conversation comes up about moving the entire business to a next generation system, we'll be able to evidence the benefits we've seen over the last number of years in these markets.

JP Doggett

Yeah, I think a lot of these companies I have been talking to sit on XXX and they’ve obviously identified end of support for XXX as a trigger for people thinking they need to do something and recognise that not everybody is going to have the budget for one of the full-suite providers or they're not going to be able to jump to that straightaway. The guys whose demo I was on yesterday had said to me that a lot of people use them as a bridge but then they often end up sticking with them.

C

The realist in me says, I will do all this work and in 25, 26 they’ll say, “we're going to stick with XXX but you need a module to do your planning scheduling”, which I will already hopefully have done the work for that.

S

Does anyone have any kind of best practices on just using XXX because not every company has the funds to go with some of the end-to-send solutions?

JP Doggett

I do know some that are using it as a platform to roll out IBP across the business. They're quite similar businesses to yours actually. There are people I can probably introduce you to and maybe we can get a discussion around it. So leave that with me.

S

Great. Yeah, that would be really excellent because I think I'd love to get a vendor, but I’m not in charge of the IT budget, right, so we need to make do with what we currently have for now for sure.

JP Doggett

Okay guys, listen, we're just about out of time so I'll say thank you very much. The one thing is, if there are any other specific aspects like an IBP discussion or any other kind of discussion that you'd find useful like this, do let me know in the chat or drop me an email.