Supply chain emissions data collection & reporting

- Goals stated for 2030 such as 30% reduction in greenhouse gas emissions but relatively little work done so far to roadmap the potential initiatives towards delivering this target;

- Stated aims have often been a reaction to perceived market pressure and reciprocating what similar businesses are pledging but this is increasingly becoming a core part of medium- to long-term strategy with internally-driven targets and priorities;

- Various in-house data collection initiatives based on available data and, where that is missing, on assumptions about averages from third party data but they may lack the integrity of industry-regulated assessments which provide a more definitive outcome;

- Collecting last three years' worth of emissions data to establish a baseline using an external provider;

- Manufacturing and sourcing (raw materials) data collection tends to be more established and comprehensive - in some cases already carbon neutral in principle - with logistics and supply chain data collection programmes some way behind. The pandemic prompted a delay to planned initiatives in this scope which are starting to receive more attention again now;

- General consensus that there are still 'win-win' sustainability and emissions reductions opportunities which will save money as well as reducing emissions footprints but that once these 'low hanging fruit' opportunities are realised, there will be tougher decisions and trade-offs to make when emissions reductions will imply an increase in costs. Without robust data, however, it is hard to quantify these opportunities;

- An additional challenge is collecting data from warehousing and distribution operations which are outsourced to a 3/4PLs;

- Some businesses with very centralised production and distribution operations that imply highly carbon-intensive distribution and service networks are tackling this as a commercial challenge as much as a sustainability challenge. Some fundamental changes to supply chain network structures, including 3/4PL relationships, are being considered as they offer the advantage to 'bake in' emissions reductions from the ground-up rather than trying to mitigate or overlay emissions reductions programmes over a fragmented supply chain ecosystem;

- Members representing consumer goods and F&B supply chains reported some ambivalence from their large retail customers regarding engagement on sustainability requirements. The impression is that a lot of focus has gone into own-brand sustainability initiatives but that there is less clarity about what retailers want from suppliers of brand products and are reasonably looking to suppliers to take a lead. However, the impression is that any sustainability benefits must also come with cost benefits to be taken into consideration i.e. sustainability benefits alone are not enough to alter cost- and profit-driven decisions. That ultimately reflects the priorities of end consumers who, when surveyed may genuinely express a desire for their purchases to be more sustainable but, at the moment of purchase still give priority to cost, especially in the current circumstances;

- Lack of data is a common stumbling block, especially accessing supplier data. Suppliers are being asked by multiple customers to provide data on provenance, raw material suppliers and other factors but the administrative burden of complying with all requests is overwhelming, not to mention the costs associated with subscribing to multiple systems. Works need to be done to help suppliers provide one set of data using a common format that can be used with different customers and different systems.

- Auditors are requiring greater proof that sustainability and/or carbon neutral pledges are backed by credible plans, especially as some of those goals have deadlines that would require action to be underway already;

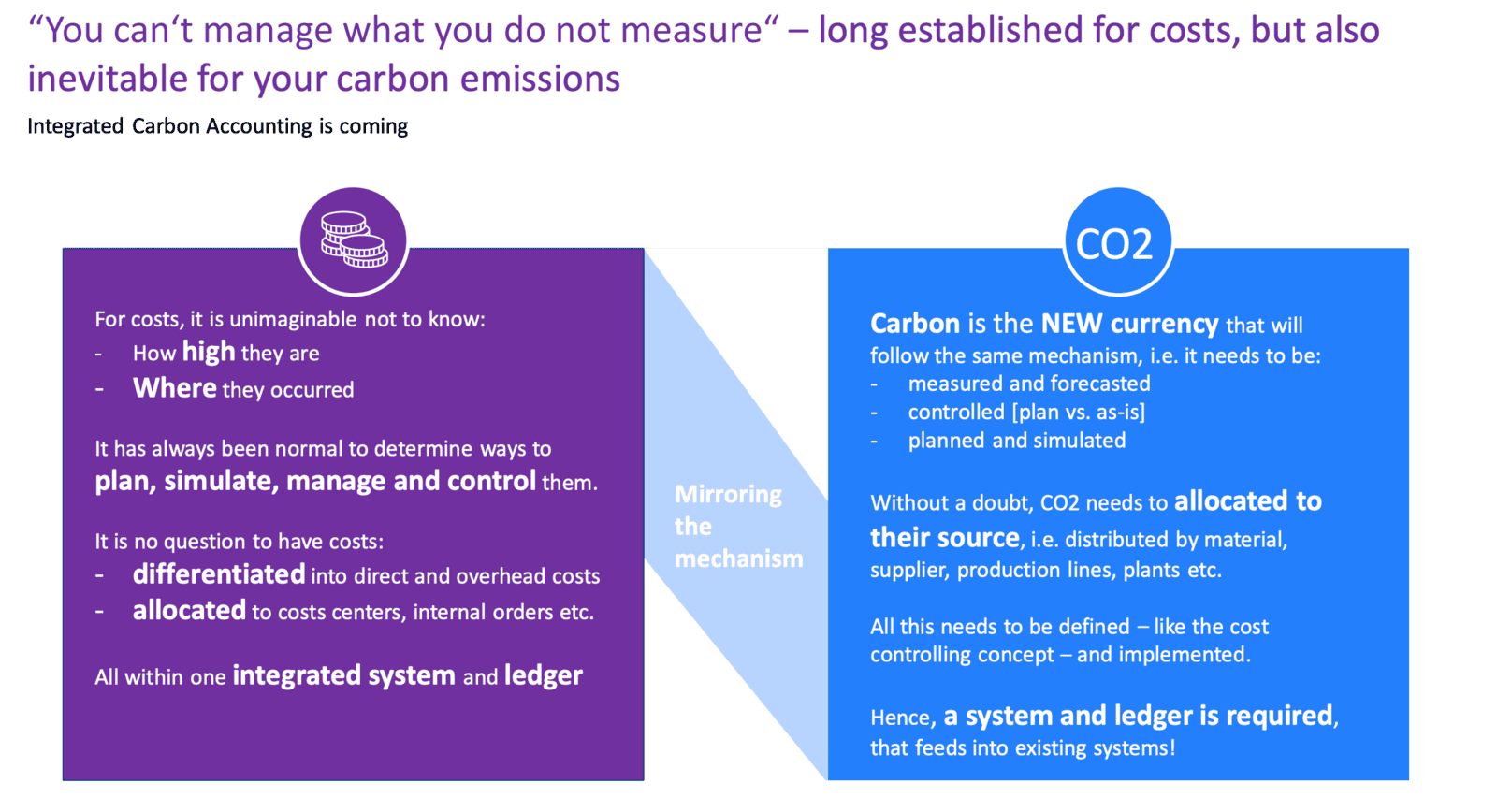

- The greater scrutiny of corporate reporting on an annual cycle is also driving a higher cadence of reporting so that emissions become a management KPI as well. It is only when emissions become a management KPI alongside existing performance KPIs that goals can be translated into actions;

- Increasing demand for Scope 3 emissions data to be granular as opposed to being based on averages based on annual data. Companies increasingly want to know what specific emissions are being generated on their behalf so that they can incorporate this into their KPIs and reporting.

Ongoing challenges

- there is an onus on manufacturers of brands to take a lead on sustainability as that is and should be part of their brand offering. However, there is public relations risk which underscores the need to be able to demonstrate the credibility of any sustainability claims;

- in addition to consumer-driven sustainability initiatives, there are also government regulations and taxes in the pipeline which will have significant implications. It's hard to have enough visibility of those requirements to have all the necessary conversation with supply chain partners and costs and changing practices but the consequences of not addressing them could include being delisted from retailers' catalogues;

- regardless of the source of impetus of sustainability improvements, there is a challenge around engaging all the necessary parts of the business to take timely action. There can be a sense that, even when a business has quite visibly stated sustainability goals, that it will be somebody else's problem to work out how to deliver them.

Potential solution

Participants were introduced a market-leading emissions calculator tool that offered the following benefits:

- a single point for emissions data collection

- an emissions calculation engine with APIs that allow data to be automatically inputted into supplier portals;

- data links to existing transactional systems so that reports on both costs and emissions can be presented on demand and on a regular schedule, alongside current management KPI reporting;

- simulation capabilities that, for example, can model a potential change of 3PL partner or using electric vehicles in part of the supply chain;

- emissions calculations can be made at a granular level for customers and/or products for real cost per unit or production or delivery, rather than averages. For example, one current user is able to calculate the carbon footprint of a specific pair of trainers delivered to a customer;

- it can incorporate real data, for example, taking into account which lane, actual trailer fill or any delays were encountered on a particular shipment so it is not reliant on assumptions;

- although this is determined by the data available, if and where there are data gaps, the data can be emulated based on the best available data to produce 'best estimates' so that simulations and projections can still be made with a high degree of confidence;

- current emissions plans and initiatives can be overlayed to produce a 'flight path' showing whether or not the business is on track to achieve its objectives;

- it is compatible with all major ERPs and can automatically pull data, avoiding the need for raw data manipulation in spreadsheets, for example. There are also existing and pending partnership with major ERPs to have the platforms algorithms built into some modules.

Sign up for monthly updates & session outputs

Tell us which sessions you'd be interested in joining

Top SC Planning Best Practices...Digested

Real lessons learned distilled from a series of practitioner exchanges on...

Digital Transformation of Supply Chain Planning

Digital transformation has been on corporate agendas for some time already but, borne of necessity, tangible progress accelerated significantly since 2020. A silver lining of the pandemic may be that the business case is clearer so the focus has shifted towards implementing and scaling digitalisation initiatives.

Supply Chain Design Modelling and Analytics

Supply chain network (re)design used to come around every few years or so, often based on quite a high level view of customer segments and associated costs. Now, competitiveness and even business continuity relies on the capability to dynamically adapt network flows based on a much more granular understanding of cost drivers.

Volatility, Agility & Resilience: Next-Level Planning

Volatility, Agility & Resilience: Next-Level Planning

Volatility, uncertainty, complexity and ambiguity was already an increasing factor before the pandemic but, now, it is clear that we need the next level of demand forecasting, sensing, planning and execution.