Planning in a 'perfect storm'

- led by Boudewijn Van Nuland, Corbion

- Strong growth continued into 2020 at a rate of 20% in Q1, fuelled by a strong demand for big brands to change their packaging and products away from plastics to bio-based alternatives;

- One of Corbion’s biggest plants was (and is) a joint venture with Total Energy which created a huge increase in demand for lactic acids, which are the building blocks of many products, so we decided to temporarily reduce our safety stocks to handle it;

- At the same time, Corbion launched a new strategy to restructure its business units which was announced three days before the first global lockdowns;

- In addition, there was unexpected (and rare) supply disruption from a lactic acid plant in Thailand as well as the shortage of chips which Corbion’s solvents are used for;

- That led to Q2 2020 being the toughest of Boudewijn’s 25-year career.

- Based on Gartner’s maturity model, Corbion’s IBP maturity was already quite high but, with all plants at full capacity, the process was struggling: there was no S&OE process as, up to that point, the IBP process was trusted to prevent crises from developing;

- Within a few months, a new S&OE process was implemented with a team member becoming a global demand consolidator and responsible for allocation. The S&OE process was linked to the S&OP / IBP process to avoid the mistake of becoming overly focused on the short-term. The ‘lighthouse’ of the 18-month horizon was important to maintain as this drives decisions about capacity building, customer segmentation and profitability;

- Corbion also introduced a new planning platform to support a global demand consolidation cycle because the bottom-up regional forecasts were no longer capable of being accurate. This also allowed them to model different scenarios more proactively. The implementation took a year;

- In the top-down element of the planning cycle, product managers became an important asset, particularly for the 6/9 to 18-month horizon, with sales / commercial teams focusing on the next 6 months or even shorter horizon periods sometimes;

- There was a baseline demand which was just based on 100% of production capabilities. The rest was growth demand where scenario modelling helped with customer segmentation and prioritising key accounts as many of the plants were multi-purpose and so could make different grades of products with different levels of profitability;

- Reliability is the main priority for key accounts so this was the focus for managing demand scenarios and, therefore, choices were made by business unit / P&L heads rather than by sales / commercial. This meant there was a centralised element to the demand planning where the product managers forecast in key account / premium customer ‘buckets’ before handing off to the regional teams to add a decentralised aspect to the process so they can use their greater granularity of insight to make choices for specific accounts at a customer and SKU warehouse level. This process was iterated over the last two years (especially with the added complexity from the shipping disruption of 2020/1) and is still being fine-tuned;

- Long range planning is based on five-year strategic plans which cover plants and assets, market, product and customer plans and growth forecasts which result in low-, mid- and high-range scenarios. This is not immediately represented in the IBP process but is used to support decisions on asset allocations and capital expenditures. That five-year plan transitions into the annual budgeting process which is where it merges into the IBP cycle.

- Corbion is an unusual business in that its core products and proposition are based on sustainability and so there is very complete and transparent sustainability data from lifecycle analysis on emissions footprints for all the products;

- There is also a lot of broader ESG data available, for example, certifying that no products are responsible for deforestation but these rely on supplier audits which were harder to maintain when there were travel restrictions;

- There is also data on the logistics component of emissions although this accounts for less of the total emissions footprint and so is not as advanced;

- This is a focus for the future where a digital twin can model the global footprint and run scenarios on which shipping lanes have most impact, for example.

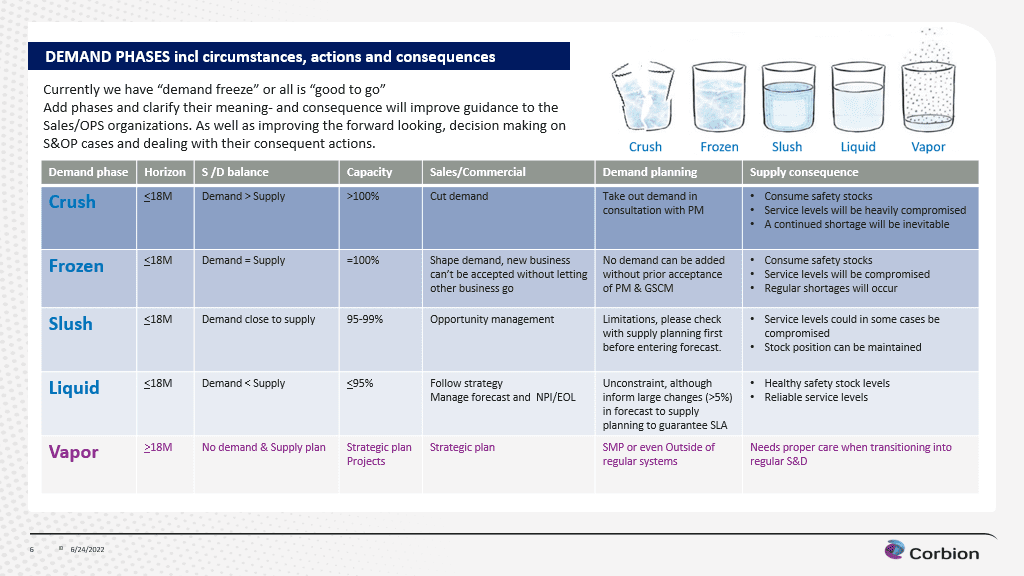

- Processes need to be adapted for different demand conditions. In Corbion’s case, they define different conditions such as ‘liquid’, ‘frozen’ and ‘crush’ (see below). The process described during the ‘perfect storm’ represented a ‘frozen’ demand situation. When demand is more ‘liquid’, more responsibility is given to sales / commercial teams to maintain their accountability for the forecast;

- The Gartner maturity model is a useful framework but needs to be tempered with a realistic assessment of overall maturity and how supply chain and the demand planning functions relates with the rest of the business, in particular, taking great care to maintain confidence in and commitment to the S&OP / IBP process;

- Similarly, don’t waste any time in addressing crises as they emerge, even if that means candidly acknowledging that it will take time to fix, because not doing so erodes trust in the overall process. Boudewijn spent a lot of time communicating with stakeholders about how problems were being addressed and what progress was being made and why it was important that not all efforts were dedicated to managing the short-term issues;

- If you can, invest in the tools before the storm hits and, if not, as soon as possible afterwards, even if that is just for the next storm. However, it’s not necessary to use all of the sophisticated functionality that many tools offer now and, in many respects, it is better not to as this risk creating a ‘black box’ whereby the outcomes are not understood and so not fully committed to. The biggest investment should go into educating and training people to adopt and believe in the tools;

- Customer segmentation and prioritisation is vital…it is impossible to keep all customers happy in such circumstances but focusing on key customers underpinned Corbion’s continued growth;

- The balance between top-down, centralised planning and bottom-up, localised planning needs careful management and the hand-off to the regional teams is the key element of that. This also needs to explicitly address the implications for incentive and bonus structures for sales / commercial teams emanating from top-down forecasts to ensure alignment with the overall business objectives;

- It wasn’t possible at the time due to investment constraints but a digital twin would also have been very helpful to manage the logistical costs during the disruption of global shipping.

Sign up for monthly updates & session outputs

Tell us which sessions you'd be interested in joining

Top SC Planning Best Practices...Digested

Real lessons learned distilled from a series of practitioner exchanges on...

Digital Transformation of Supply Chain Planning

Digital transformation has been on corporate agendas for some time already but, borne of necessity, tangible progress accelerated significantly since 2020. A silver lining of the pandemic may be that the business case is clearer so the focus has shifted towards implementing and scaling digitalisation initiatives.

Supply Chain Design Modelling and Analytics

Supply chain network (re)design used to come around every few years or so, often based on quite a high level view of customer segments and associated costs. Now, competitiveness and even business continuity relies on the capability to dynamically adapt network flows based on a much more granular understanding of cost drivers.

Volatility, Agility & Resilience: Next-Level Planning

Volatility, Agility & Resilience: Next-Level Planning

Volatility, uncertainty, complexity and ambiguity was already an increasing factor before the pandemic but, now, it is clear that we need the next level of demand forecasting, sensing, planning and execution.